Murdock Group Acquires 6.4% of Beverly’s Stock

- Share via

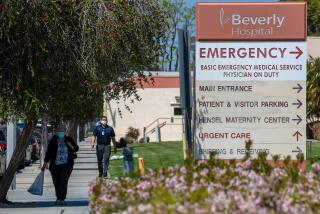

Los Angeles financier David H. Murdock and companies he controls have bought 6.4% of troubled Beverly Enterprises, the nation’s largest nursing home operator.

Murdock, in a filing with the Securities and Exchange Commission, said he regards Beverly’s stock as “an attractive investment” at current prices. Murdock said he has no plans to propose a merger or similar transaction or to launch a tender offer for the rest of the company’s stock.

Murdock also took the unusual step of stating in the filing that he has met with representatives of Pasadena-based Beverly and “has expressed support for management.”

Both Murdock and Beverly declined to comment on the filing. A group led by the wealthy Pritzker family of Chicago recently bought about 6% of Beverly’s stock, raising speculation of a possible buyout.

Murdock’s acquiring group also includes Flexi-Van Corp., Flexi-Van Leasing and Flexi-Van Delaware. Flexi-Van paid $22.2 million for its 3.4 million Beverly shares, according to the filing. The filing did not state how much Murdock paid for his 36,200 shares.

Beverly recently reported a third-quarter net loss of $11.5 million, which included pretax charges of about $9.5 million. In the same period last year, the company recorded a $3.6-million profit. Revenue slipped 4% to $510.2 million.

Beverly said it expects to report a loss for 1988. Last year, the company posted a net loss of $30.5 million.

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.