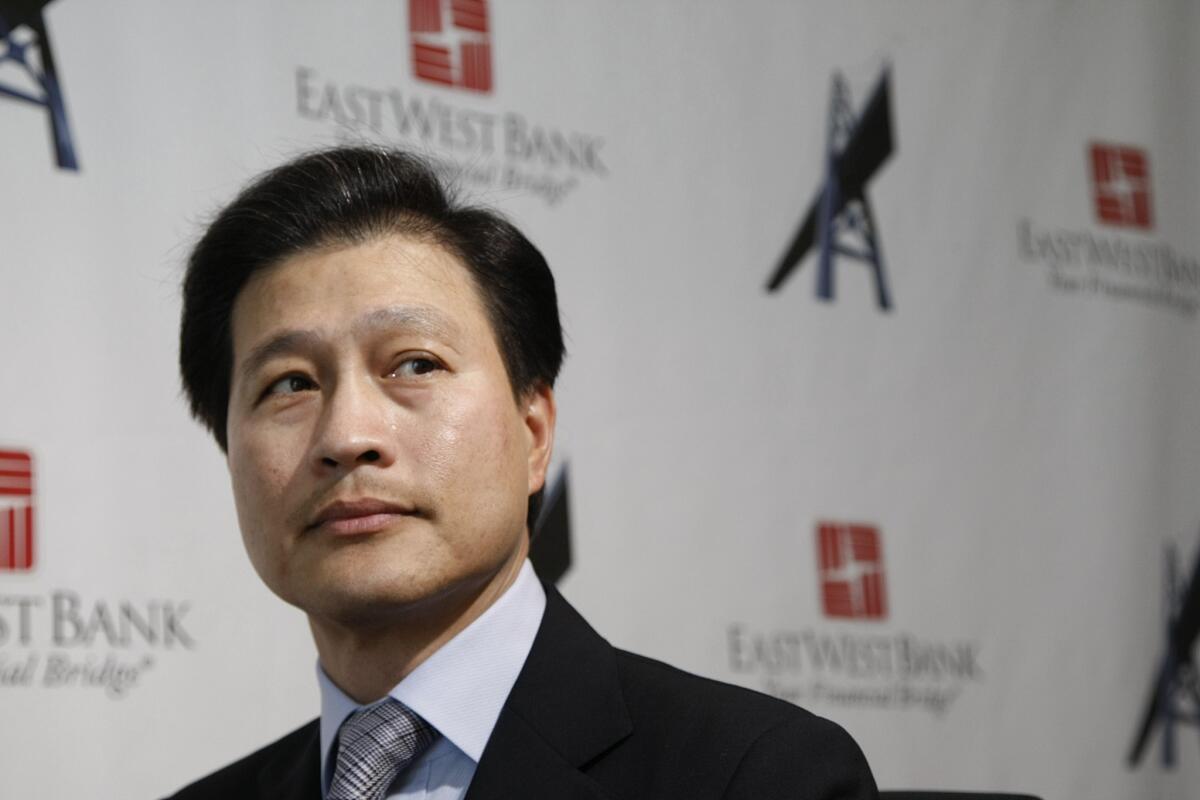

East West and Cathay banks report higher first-quarter earnings

- Share via

The two largest Chinese-American banks reported higher first-quarter earnings on solid loan growth, with profit up 6% at Pasadena’s East West Bancorp and 9% at Los Angeles’ Cathay General Bancorp.

East West, with total assets of $27.4 billion, said Wednesday that it earned $76.7 million, or 54 cents per share. That compared with $72.1 million, 50 cents per share, in the year-earlier period.

The results included $10.6 million in merger costs related to East West’s acquisition of MetroCorp Bancshares Inc., a Texas bank, in January. That lowered per-share earnings by 4 cents.

PHOTOS: Top 10 Southern California companies

Cathay General, with $11.3 billion in assets, said it earned $31.3 million, or 39 cents a share, up from $28.8 million, or 30 cents a share.

Cathay’s per-share earnings got a boost when it paid off its remaining bailout-era debt from the federal government’s Troubled Asset Relief Program in September, allowing the bank to stop paying dividends to Uncle Sam.

ALSO:

East West Bank as builder of bridges

After nearly five years, Cathay repays TARP

More to Read

Inside the business of entertainment

The Wide Shot brings you news, analysis and insights on everything from streaming wars to production — and what it all means for the future.

You may occasionally receive promotional content from the Los Angeles Times.